Tefaf focuses on online market in addendum to annual art market report

Findings detail the supply side of the digital sales equation, point toward hybrid models

by SARAH P. HANSON | 29 June 2017

The Art Newspaper

The size of the online market depends on the definition and price range of artworks, Tefaf's addendum report finds

The European Fine Art Fair (TEFAF) in Maastricht today (29 June) released its Art Market Report: Online Focus, a supplement to the annual Art Market Report released in March.

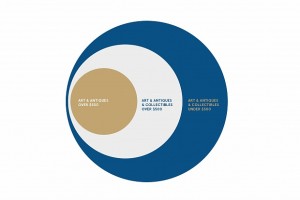

Her findings mostly confirm the most noticeable trends, namely that large auctioneers who have embraced their digital platforms—Heritage, Christie’s, and Sotheby’s—claim the largest share of an estimated $3.1b market (which the Hiscox Online Art Sales Report puts it at $3.75b; Art Basel’s The Art Market 2017 report, $4.9b). Pownall’s report further qualifies that of the $3.1b, fine art and antiques account for only $2.6b (the rest being other collectibles, automobiles, wine, etc).

The data is derived from “profiles of 100 companies”, 39 of which responded to a survey; a survey of more than 8,000 dealers, with a response rate of 8%; and a sample of data from 3,349 auction houses who list on Tefaf partner Invaluable. In her surveys, Pownall defined art as “objects including fine art, antiques, decorative art, collectibles, haute jewellery, photography, and design”, but the queried companies include e-tailers like Etsy and RubyLane alongside art-specific businesses.